Introduction

Welcome to our detailed guide on UK Tax Types. As a leading MRI company, Millbrook Accountancy is committed to providing top-notch tax and accountancy services in the UK. In this article, we will delve into the diverse landscape of taxes in the United Kingdom, covering everything from income tax to property taxes and more.

UK Tax Types: Unveiling the Fiscal Landscape

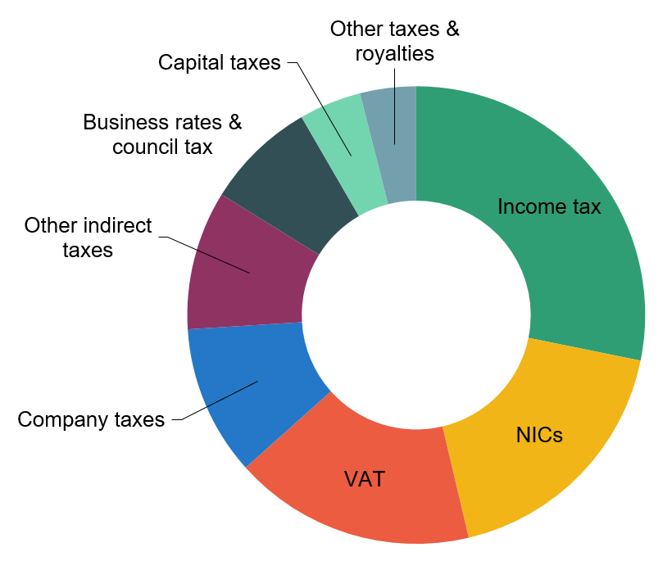

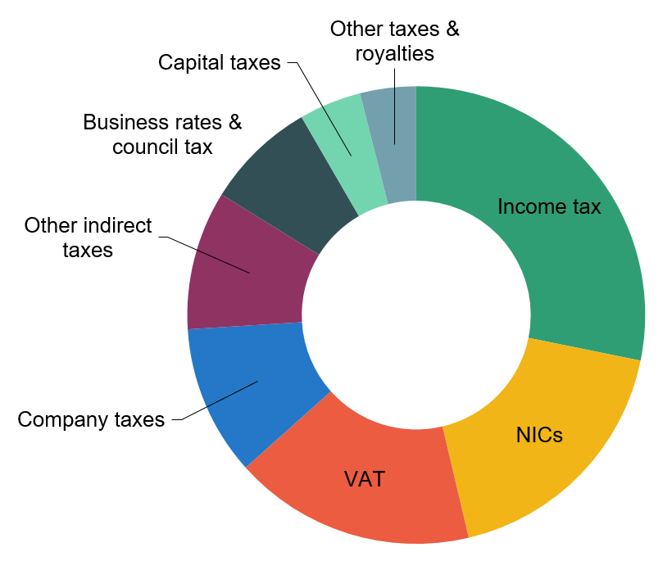

Taxation in the UK

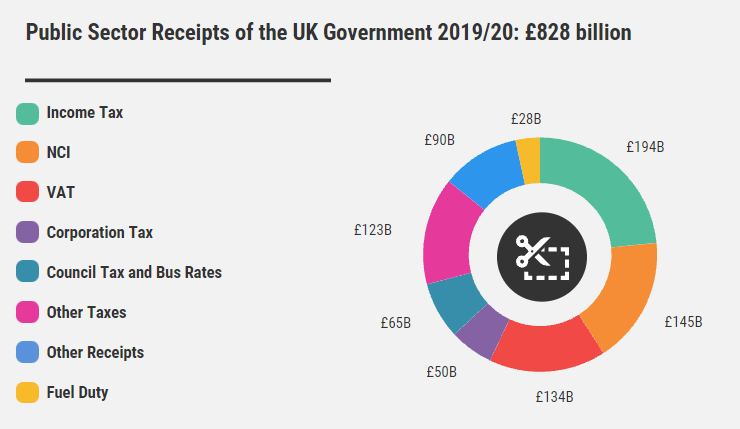

Taxes play a pivotal role in the UK’s financial ecosystem, contributing significantly to the government’s revenue. With HMRC overseeing national taxes and local councils managing local levies, the UK collected a staggering £828 billion in the fiscal year 2019/20.

Taxes Administered by HMRC

Her Majesty’s Revenue and Customs (HMRC) manages a plethora of taxes, including:

- Income Tax

- Inheritance Tax

- VAT

- Capital Gains Tax

- Corporation Tax

- Insurance Premium Tax

- Environmental Taxes

- Stamp Duty

- Land and Fuel Taxes

- Climate Change Levy and Landfill Tax

- Customs Duty

- Excise Duty

Taxes Administered by Local Authorities

Local councils collect vital revenues through Council Tax and Business Rates. Understanding the tax liability of UK residents is crucial, with over 30 million taxpayers navigating the intricate tax system.

Personal Taxes

Delving into personal taxes, we explore:

Income Tax

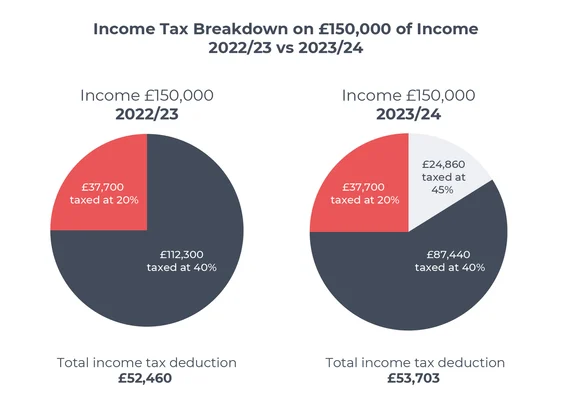

Income tax, a cornerstone of UK taxation, employs progressive rates. We detail the tax bands for England/Wales/Northern Ireland and Scotland, providing insights into allowances and rates.

Inheritance Tax

A critical consideration postmortem, inheritance tax is demystified. We explain thresholds, rates, and exemptions, emphasizing the role of qualified accountants in optimizing tax burdens.

Council Tax

Local councils fund essential services through council tax. We decipher the factors influencing tax charges and eligibility for reductions or exemptions.

Sales Tax and Other Duties

Unraveling the intricacies of sales tax and related duties, we explore:

VAT

As the third-largest income source for the government, Value-Added Tax (VAT) is dissected. Standard rates, reduced rates, and zero rates are elucidated for various goods and services.

Excise Duty

Indirect taxes on designated goods are explored, emphasizing the impact on products like tobacco and alcohol.

Motoring Duty

From London Congestion Charge to Fuel Duty and Vehicle Excise Duty (VED), this section navigates through taxes associated with vehicles.

Property Taxes

An in-depth analysis of property taxes, including:

Stamp Duty Land Tax (SDLT)

SDLT implications on property purchases are outlined, with recent threshold adjustments highlighted.

Rental Income

Tax considerations for rental income are discussed, shedding light on reporting obligations and exemptions.

Dividend Income

Navigating dividend income tax rates, allowances, and implications on total income.

Business Taxation

Delving into the corporate realm, we explore:

Corporation Tax

A comprehensive overview of corporation tax, including recent rate adjustments and practical insights for businesses.

Business Rates

Understanding business rates for various premises and considerations for designated welfare activities.

Business and Personal Taxes

Examining the nexus of business and personal taxes, including:

National Insurance Contributions (NIC)

Classifying NIC categories and their implications for state benefits.

Capital Gains Tax (CGT)

Unpacking the complexities of CGT, exemptions, and reporting obligations.

Tax System for Foreigners

A guide for foreigners, encompassing AEIA, Short Term business visitors, and tax considerations for non-domiciled residents and international students.

Taxes on Imports and Exports

Navigating the tax implications for imported and exported goods, including recent changes and considerations for trading with the EU.

Tax Refunds

Insights into the tax refund process, outlining eligibility criteria and the application procedure.

Conclusion

In conclusion, taxation in the UK is a multifaceted landscape, and understanding its nuances is crucial for individuals and businesses alike. With Millbrook Accountancy, you gain a valuable partner in navigating the complexities of UK taxes, ensuring compliance, and optimizing your financial position. Explore our comprehensive guide to make informed decisions in the ever-evolving realm of UK taxation.

The varied tax types discussed in this guide underscore the importance of professional advice and expertise. As tax laws evolve, having a qualified accountant with up-to-date knowledge can make a substantial difference. Millbrook Accountancy prides itself on providing not just services but solutions tailored to your unique tax needs.

Remember, taxation is not just about meeting obligations but also about making strategic choices that positively impact your financial health. Whether you’re an individual taxpayer, a business owner, or an international student, understanding the tax implications specific to your situation is paramount.

We encourage you to reach out to Millbrook Accountancy for personalized assistance. Our team of experienced professionals is equipped to address your queries, provide strategic insights, and ensure you navigate the UK tax landscape with confidence.

Stay informed, stay compliant, and let Millbrook Accountancy be your trusted partner in achieving financial success in the United Kingdom. As the fiscal landscape continues to evolve, count on us to keep you ahead of the curve.

Contact Millbrook Accountancy today for unparalleled expertise and personalized tax solutions tailored to your unique needs.