In the fast-paced world of ecommerce, managing finances is a crucial aspect of ensuring the success and sustainability of your business. Whether you’re a seasoned ecommerce entrepreneur or just starting out, mastering the art of bookkeeping is essential for making informed financial decisions and keeping your business on track. In this comprehensive guide, we’ll delve into the intricacies of ecommerce bookkeeping, offering valuable insights and practical tips to help you streamline your financial processes and maximize your profits.

Understanding Ecommerce Bookkeeping

What is Ecommerce Bookkeeping?

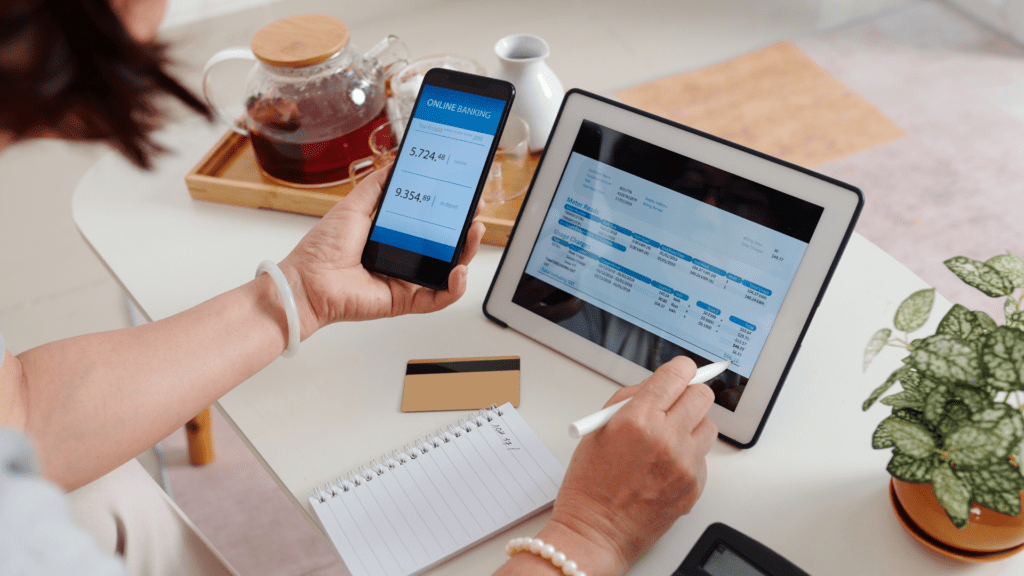

At its core, ecommerce bookkeeping involves the meticulous recording and organization of financial transactions related to your online business. From tracking sales and expenses to managing inventory and reconciling accounts, effective bookkeeping is essential for maintaining financial clarity and ensuring compliance with tax regulations.

The Importance of Ecommerce Bookkeeping

Dependable Plan of Action

Establishing a robust bookkeeping system provides you with a clear understanding of your business’s financial health, allowing you to make informed decisions and avoid unpleasant surprises when it comes to managing cash flow and meeting financial obligations.

Determine Your Business Goals

By maintaining accurate financial records, you can better analyze your business’s performance, identify areas for improvement, and set realistic growth targets. This insight is invaluable for developing strategic plans and maximizing your business’s potential.

Readiness of Your Tax Assessment and Filing

Proper bookkeeping not only saves you time and headaches during tax season but also ensures compliance with tax laws and regulations. By maintaining detailed records of your income and expenses, you can minimize the risk of errors and penalties and optimize your tax deductions.

Advantages of Ecommerce Bookkeeping

Gain Insight into Your Finances

By regularly tracking your income and expenses, you gain valuable insights into your business’s financial performance, allowing you to identify trends, spot potential issues, and make informed decisions to drive growth and profitability.

Create a More Successful, Sustainable Business

A solid bookkeeping system provides the foundation for a successful and financially sound business. By maintaining accurate records and monitoring key financial metrics, you can identify opportunities for improvement, mitigate risks, and ensure the long-term viability of your ecommerce venture.

Set Definite Growth Benchmarks

With a clear understanding of your financial position, you can establish realistic growth targets and track your progress over time. By setting measurable goals and monitoring your performance against them, you can stay focused and motivated to achieve success.

Recognize Trends and Early Warning Signs

By analyzing your financial data regularly, you can identify emerging trends and early warning signs of potential issues before they escalate. Whether it’s declining sales, rising expenses, or cash flow challenges, proactive monitoring allows you to take corrective action and safeguard your business’s financial health.

Better Control of Financial Flow

Effective bookkeeping enables you to maintain better control over your cash flow, ensuring that you have the funds you need to cover expenses, invest in growth opportunities, and weather any unexpected challenges that may arise.

Create Projections for Cash Flow and Inventory

By analyzing past financial data and trends, you can develop accurate projections for future cash flow and inventory requirements. This allows you to anticipate and prepare for fluctuations in demand, manage inventory levels effectively, and optimize your business’s operations.

Run Your Business Based on Verifiable Information

With reliable financial records at your fingertips, you can make informed decisions based on facts rather than guesswork. Whether it’s pricing products, negotiating with suppliers, or allocating resources, having access to accurate financial data empowers you to make choices that drive profitability and growth.

Avoid Frightful Tax Notices, Fines, and Penalties

Maintaining accurate records and complying with tax laws are essential for avoiding costly mistakes and penalties. By staying organized and up-to-date with your tax obligations, you can minimize the risk of audits, fines, and other consequences that could harm your business’s reputation and bottom line.

Increase Client Lifetime Value by Utilizing Data

By leveraging customer data and insights gained from your bookkeeping efforts, you can enhance the customer experience, build loyalty, and increase customer lifetime value. Whether it’s personalizing marketing campaigns, improving product recommendations, or enhancing customer support, data-driven strategies can help you strengthen relationships with your audience and drive repeat business.

The Right Way to Do Ecommerce Bookkeeping

Separate Your Business and Personal Finances

One of the first steps in effective bookkeeping is to separate your business and personal finances. By maintaining separate bank accounts and credit cards for your business, you can easily track income and expenses, simplify tax preparation, and avoid potential confusion or discrepancies.

Select a Suitable Bookkeeping System

Choosing the right bookkeeping system is essential for maintaining accurate records and streamlining your financial processes. Whether you opt for single-entry or double-entry accounting, consistency is key. Select a system that meets your business’s needs and preferences, and stick with it to ensure continuity and reliability.

Create a Chart of Accounts

A chart of accounts serves as the backbone of your bookkeeping system, providing a framework for organizing and categorizing financial transactions. By creating a clear and comprehensive chart of accounts, you can easily track income, expenses, assets, liabilities, and equity, making it easier to generate accurate financial reports and statements.

Keep All Necessary Data on Record

Recording every transaction, no matter how small, is essential for maintaining accurate and reliable financial records. Be sure to keep detailed records of invoices, receipts, contracts, and payments, and organize them systematically for easy retrieval and reference.

Constant Attention

Consistency and attention to detail are essential for effective bookkeeping. Make it a habit to update your records regularly, reconcile accounts, and review financial reports to ensure accuracy and completeness. By staying on top of your bookkeeping tasks, you can avoid costly mistakes and make informed decisions to support your business’s growth and success.

Create Financial Reports

Regularly generate financial reports, such as income statements, balance sheets, and cash flow statements, to track your business’s performance and monitor key metrics. These reports provide valuable insights into your financial health, helping you identify strengths, weaknesses, and opportunities for improvement.

What Does an Ecommerce Bookkeeper Do?

An ecommerce bookkeeper plays a critical role in maintaining accurate financial records, categorizing transactions, and generating timely financial reports. Whether you choose to hire an in-house bookkeeper, work with a freelance professional, or outsource bookkeeping services, it’s essential to find a qualified and experienced professional who understands the unique needs and challenges of ecommerce businesses.

How to Master Ecommerce Bookkeeping

Mastering ecommerce bookkeeping requires a combination of knowledge, skills, and attention to detail. Whether you choose to learn bookkeeping yourself or hire a professional to handle it for you, there are several key tips and procedures to keep in mind:

- Choose the Right Accounting Software: Select accounting software that meets your business’s needs and allows you to accurately record and track financial transactions.

- Keep Track of Your Cashflow: Monitor your cash inflows and outflows regularly to ensure healthy cash flow management and financial stability.

- Understand Your Costs of Goods Sold: Calculate your cost of goods sold (COGS) accurately to determine your gross profit margin and make informed pricing decisions.

- Calculate Your Break-even Sales Requirements: Determine your break-even point to understand the sales volume needed to cover your expenses and achieve profitability.

- Keep All Necessary Data: Maintain detailed records of invoices, agreements, and payments to support your bookkeeping efforts and facilitate tax compliance.

- Monitor Your Inventory: Implement a reliable inventory management system to track inventory levels, optimize stock levels, and prevent stockouts or overstock situations.

- Utilize Advanced Bookkeeping Software: Take advantage of advanced bookkeeping software to automate routine tasks, streamline processes, and access real-time financial data for informed decision-making.

- By following these tips and procedures, you can master ecommerce bookkeeping and lay the foundation for a successful and financially sound business.

- Conclusion

- In conclusion, ecommerce bookkeeping is a vital aspect of managing an online business effectively. By establishing sound bookkeeping practices, you can gain valuable insights into your finances, make informed decisions, and drive sustainable growth and profitability. Whether you choose to handle bookkeeping yourself or enlist the help of a professional, prioritizing financial clarity and accuracy is essential for long-term success in the competitive world of ecommerce.